Green Star rated assets outperform the market

30 May 2023

According to Anthony de Francesco, Founder and Director at Real Investment Analytics (RIA), the financial benefits of Green Star certifications in the Australian market are going from strength to strength.

Anthony was one of the founders of green building investment data analytics in Australia. He has been assessing the performance of Green Star certified assets since 2011 when he established the Green Property Index, which tracked the investment performance of commercial office buildings awarded an environmental rating using Green Star and NABERS.

With formal qualifications in economics and econometrics, Anthony’s industry experience covers numerous research and analytical roles in the areas of property investment, asset allocation modelling, data and quantitative analysis, and product and business strategy.

Earlier analysis by Green Building Council of Australia using the Property Council’s Office Market data, has shown that 27% of Australia’s CBD office space has a Green Star Design and As Built rating.

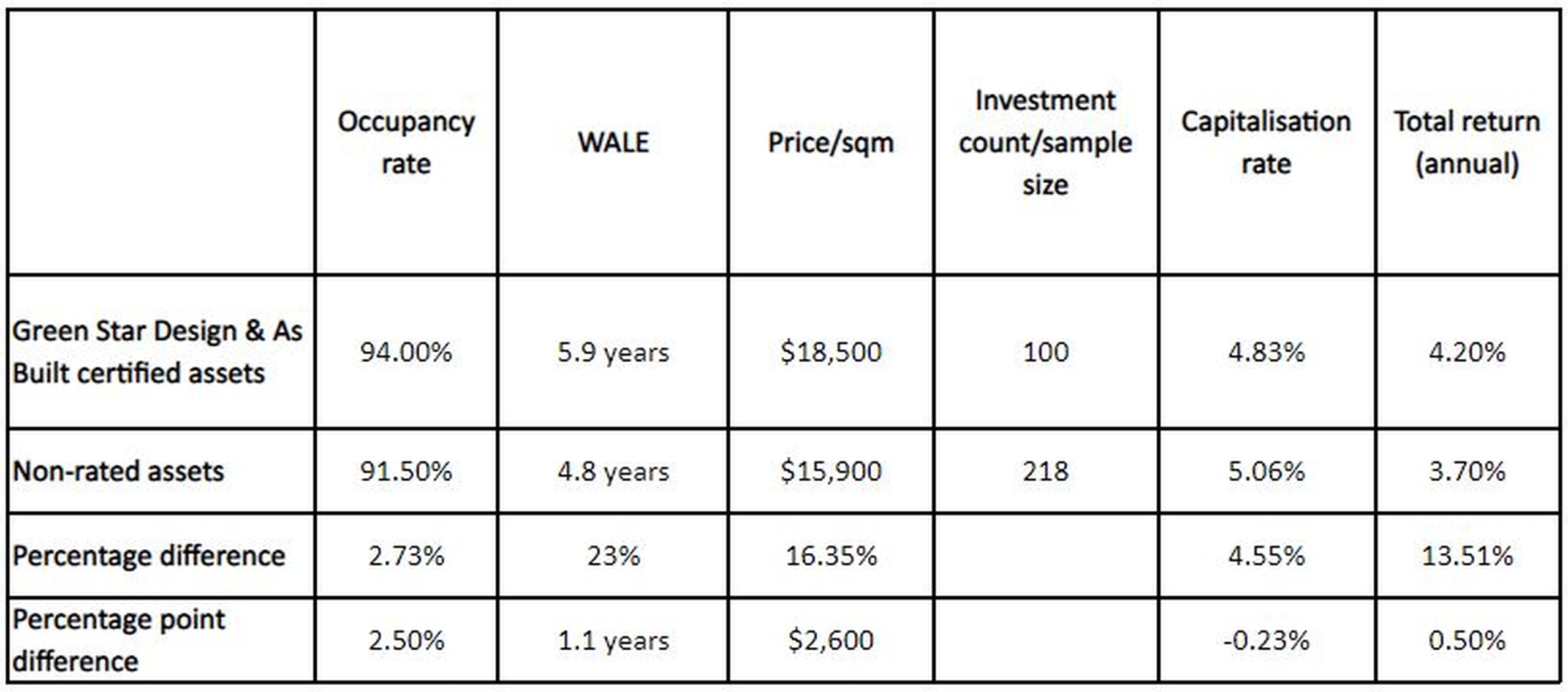

The GBCA has now shared data with Anthony that has enabled him to compare the performance of individual office property (asset) investments with and without Green Star Design and As Built certifications. The property performance metrics considered include:

- occupancy rate

- weighted average lease expiry (WALE)

- capitalisation rate

- price/sqm, and

- total return

The research team at RIA compared the performance of these green rated investments with a pool of non-rated office assets, mainly comprised of prime quality assets.

“The findings for the year to December 2022 are generally favourable for Green Star rated investments. Specifically, we find that Green Star rated investments have, on average, a higher occupancy rate, a longer WALE, a lower cap rate and higher price/sqm than the non-rated sample,” Anthony said.

The driver for this difference is “Essentially tenants demanding buildings with green attributes,” Anthony explained, “This is important because it’s a signal that tenants are environmentally conscience and demand office buildings that are more energy efficient and have a lower carbon footprint.”

The new research has implications for non-rated assets going forward, with Green Star rated buildings being viewed as “less risky due to their relatively favourable performance. Conversely, non-rated buildings will generally be viewed to be riskier assets. So, overtime, the pool of non-rated buildings will diminish,” Anthony predicted.

This means an increase in healthier, decarbonised assets are on the horizon, “Over time, the office property sector will see more developments with green attributes. Indeed, this is already happening.”

The key findings of the Real Investment Analytics research are presented in the table below. The figures are as at December 2022.

Are you ready to future proof your asset? Green Star Buildings is here to help. If you're ready to build better buildings for people and the planet learn more about Green Star Buildings here.