Five minutes with Alicia Maynard, ISPT

29 Jun 2021

When it comes to sustainable property and its role in responsible investments for superannuation funds, Alicia Maynard is an industry leader. Alicia is General Manager, Sustainability and Technical Services for ISPT, a 15-year member of GBCA. She is a member of our 2021 Green Star Industry Advisory Group, one of our inaugural Green Star Champions and was a Green Star assessor for three years. Alicia is also the person to talk to about ESG strategy and how investor expectations can be upheld with carbon neutral buildings, so we spent five minutes with her to learn about ISPT and the issues most important to investors today.

1. Alicia you started out as a civil engineer with Forbes Shire Council and you’ve gone on to work in sustainability roles with several GBCA members including Arup, Lendlease and now ISPT. When did you realise that sustainability was your calling?

The tipping point in my structural engineering career and move from engineering to sustainability came when I was working on the structural design of a new commercial office tower, where two existing 20 year old buildings were being demolished. I could not come to terms with the waste of time, money and resources to build the new tower at the expense of the two existing fully functional buildings, and started to investigate closed loop design thinking and design principles of long-life, low-energy and loose fit, before changing jobs and moving into my first sustainability dedicated role.

2. ISPT invests in property for some of Australia’s largest industry super funds. What can you tell us about the diversity of ISPT’s portfolio?

For over 25 years our properties have been meaningful places for the retailers, companies, government departments and communities that use them. We generate returns for our Investors, which are some of Australia’s largest industry superannuation funds, and ultimately the 50%+ of working Australians who have their retirement savings invested in property through us.

ISPT’s $19.3 billion portfolio invests in and develops commercial, retail, logistics, warehousing and residential property in Australia.

3. Environment Social Governance (ESG) excellence underpins ISPT’s approach to investing and ISPT is a leader in this space. What issues are most important to your investors?

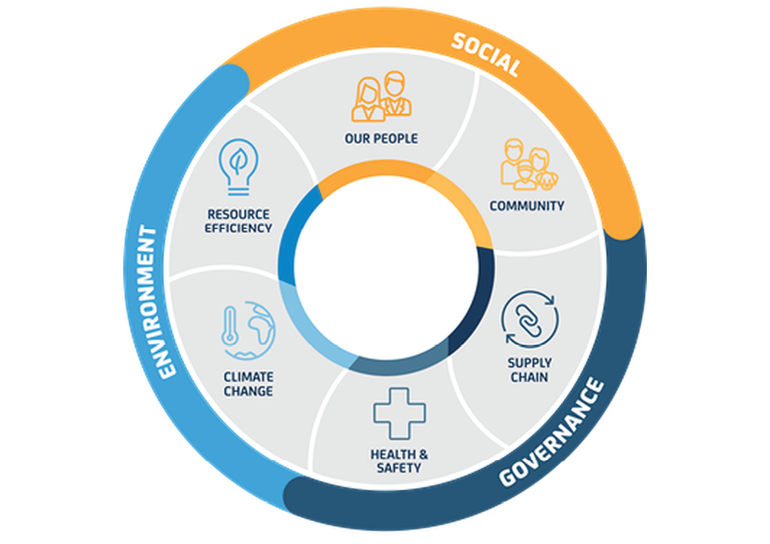

As part of our ESG strategy refresh last year, we consulted with investors, customers and our communities to understand the most important issues – climate change was referenced by everyone as being the most critical issue we are collectively facing. Modern slavery, waste, water and community engagement were also by our stakeholders as important. These issues have formed the basis of our 2025 ESG Strategy and ESG framework.

4. ISPT is already 100% carbon neutral and one of your flag on the hill targets is to generate more carbon offsets than you use by 2025. Can you tell us how ISPT will make this happen?

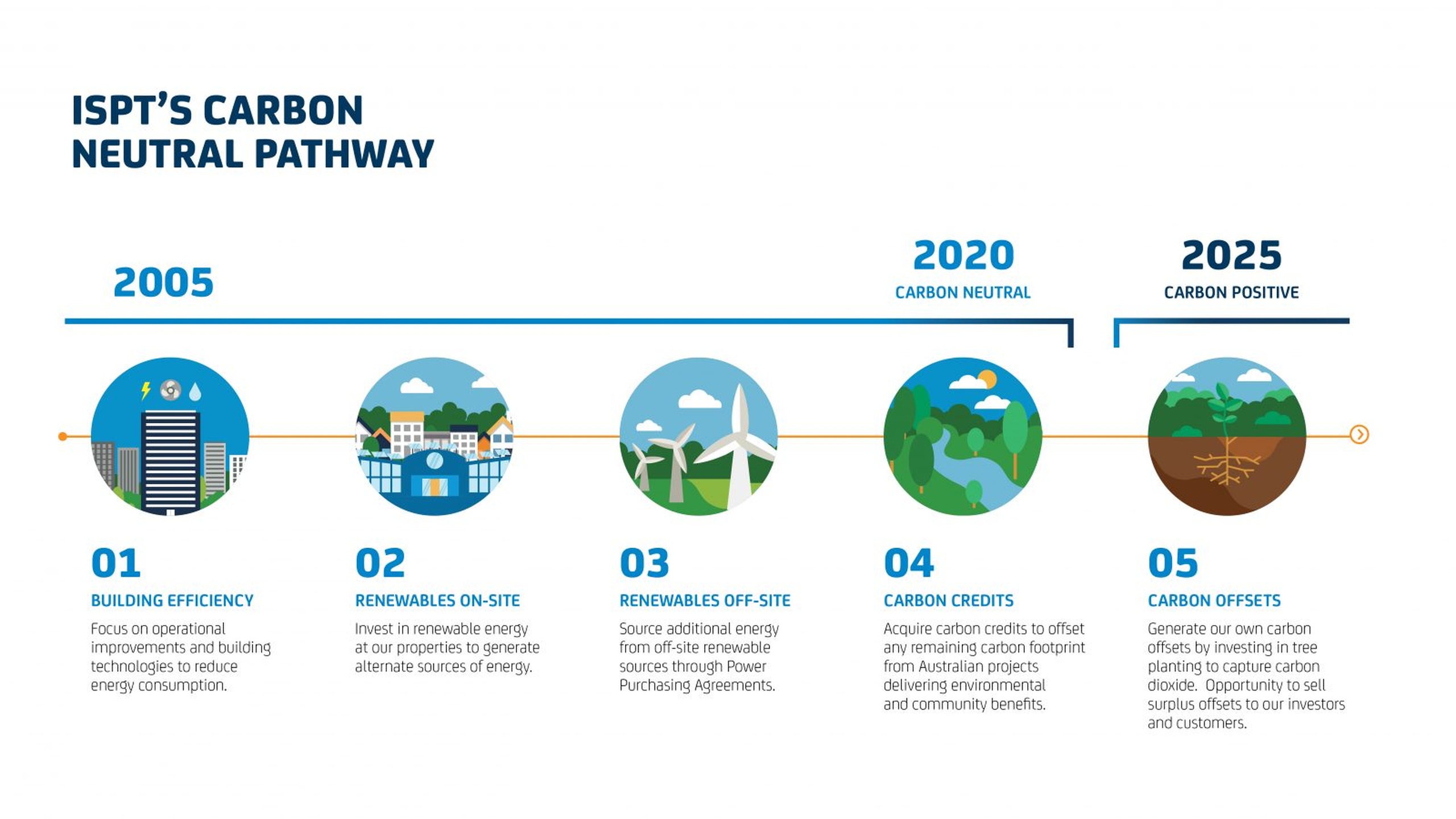

Our 2020 carbon neutral certification for the base building operations (Scope 1, Scope 2 and some Scope 3 emissions) on all ISPT owned and operated properties, as well as our corporate offices, builds on a commitment for over 15 years to managing climate risks in our portfolio and operations through energy efficiency, onsite renewables, offsite renewables through Power Purchase Agreements (PPAs), and then by offsetting the remainder of emissions with ACCUs.

Beyond our carbon neutral achievement, we are targeting to become a net positive producer of carbon offsets by 2025. We’ll achieve this longer-term target in multiple ways, including further power purchase agreements (PPAs), carbon sequestration through carbon conservation landbanking and rolling out Stages 3 and 4 of our National Solar PV Project.

5. ISPT has over 70 Green Star Performance rated projects in its portfolio. How has the Green Star – Performance system helped ISPT achieve its sustainability goals?

Environmental ratings are important industry tools that provide a snapshot of our impact and improvements over time. We use a number of rating systems to measure and track our sustainability performance and hold ourselves accountable to sustainable improvement across our portfolio and operations. Green Star ratings provide us with third-party design, construction and performance verification. We have over 70 retail and commercial buildings rated in Green Star Performance to benchmark their current environmental performance and allow us to prepare tailored building roadmaps to improve performance and reduce outgoings.